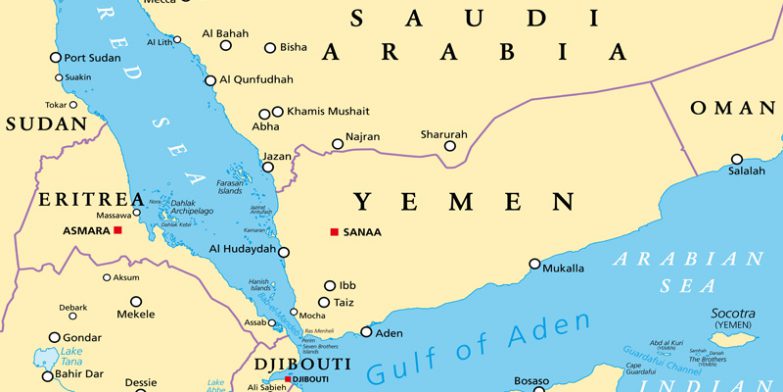

The Gulf of Aden is the approach to the Suez Canal from Asia, with 50-60 vessels transiting each day, but as a result of the situation in Israel attacks in the Red Sea and Gulf of Aden on merchant shipping are increasing, with a Norwegian vessel hit on Tuesday.

Zim Line, Maersk and Hapag-Lloyd have imposed emergency risk surcharges and there is a war risk premium for vessels going to Israeli ports and we may see the war risk premium expanded throughout the Red Sea and Gulf of Aden.

On the 3rd December, a UK owned container ship operated by OOCL, was hit by a rocket fired by a drone and any intensification of ship attacks in the Red Sea could potentially tie up 30% of the global container ship fleet, as more vessels will need to be rerouted

ZIM has already diverted its ships from the Suez to the longer route around the Cape of Good Hope, while Maersk rerouted two ships chartered from Israeli interests, with more ships expected to follow suit.

The route around Africa is about 7,000 nautical miles longer and adds 10 days to the transit time and while this route incurs higher fuel costs it does avoids Suez Canal fees, which are due to increase.

There is also the issue of marine insurance to consider, because changing the shipping route could affect the insurance policy’s validity, in the event of a claim.

Data shows that the average cost per container for Asia-Mediterranean shipments increased 9% in November, compared with October, while rates from some Chinese origins to Israel climbed between 16% and 36%, suggesting that the war is leading to higher costs.

This is a fast moving, complex situation and we are monitoring it closely, so that we can implement contingency plans if necessary and keep you updated with the most important developments.