Following the early January escalation of attacks on container ships off the coast of Yemen the major container shipping lines began diverting vessels away from the Suez Canal and around the southern tip of Africa.

Re-routing container ships around the Cape of Good Hope adds 3,500 nautical miles to a typical journey from Asia and instantly delayed afloat shipments to Europe and the US East Coast another 5-14 days, potentially adding weeks to delivery times and with delays threatening the availability of some products shippers need to know exactly where their consignments are and what their updated ETAs are.

Using a standard speed of 17 knots during the deviation, we are looking at a likely increase in transit time of roughly 10 days on Far East-North Europe, 14 days to MED, and 5 days to NAEC.

The inability of vessels to hit their port berthing window impacts shippers and other carriers that have goods or equipment tied up on the ocean voyage, with ripple impacts along the extended supply chain.

While the impact of this action will be felt on multiple trades, its impact will be most profound on traffic from Asia and will be particularly troublesome on the Far East to North America East Coast (NAEC) trade, as there has been a shift towards the Suez routing due to the drought in the Panama Canal, making a reversal to the Panama routing impossible.

Using the number of services on the impacted trades, the average vessel size on each service, and an additional vessel for every 7-day increase in sailing time, a switch to round-Africa would require 1.7 Million TEU of vessel capacity, which is around 6% of the total global container vessel capacity (just 4% is currently idled).

Every week there is approximately 390,000 TEU loaded from Europe and USEC going to the Far East as a mix of full and empty containers and having already lost two weeks sailing round-Africa 780,000 TEU of containers less will arrive in Far East in time for the beginning of the Chinese New Year peak over the next 4 weeks, which will create shortages in key locations.

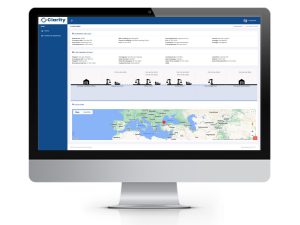

With our enhanced Clarity tracking tool, you can actually ‘see’ where your consignments are, with verified ETAs, which means you have visibility of any delays, so that you can plan and communicate within your business and to end clients.

Clarity tracking follows all ships carrying containers with our cargo, detecting and verifying any ETA change, providing you with an ‘early warning system’ so that you can adjust your supply chain planning accordingly.

It is expected that vessels from Asia will continue to be delayed for the foreseeable future and cascading equipment shortages will present increasing challenges at loading ports.

For further information on our free Clarity Tracking system and to discuss how we can enhance your supply chains, please EMAIL Andy Costara.